Our Family’s Money Routine

Get a behind-the-scenes look at our family’s money routine– how we manage our budget, paying bills, planning for future expenses, and more!

For years, I pretty much ignored all things money-related in our house.

I’m not a big spender, and I have always been more book-ish than math-y, so finances didn’t really seem to be in my wheelhouse.

My husband Donnie is more of a finance guy and started doing the bills when we got married, so I let him have at it.

And he did a great job! He would occasionally try to rope me in on things or get me interested in what was going on with our accounts, but I was busy chasing around two wild little boys and starting a blog, so I never got into it.

My Financial “Aha” Moment

But eventually I realized that I was doing Donnie a disservice by basically sticking my head in the sand and causing him to carry the entire mental load with our finances.

And though he was keeping up with the bill paying, he knew we could be more intentional about how we spent our money. And that was only going to happen if we both got involved.

Never one to do anything halfway, I created a printable budget binder and eventually a budget spreadsheet to help me keep track of our spending. (Because budgeting is a lot more fun when it’s pretty, amiright?!)

And for several years now, Donnie and I have had a consistent “money routine” that has worked well for our family.

Because I always find it interesting to get a behind-the-scenes look at how other families do things, I thought I’d walk you through our routine in case it would be helpful for anyone else out there!

Our Money Routine: Some Caveats

But before I dive in, I want to give a few caveats.

This post is not meant to be a prescription for “the perfect money routine.” Everybody’s needs and preferences and schedules and households and personal situations are going to be different.

The way we handle finances in our house is just one way– of an infinite number of ways– that it can work.

We didn’t form this routine overnight. Donnie and I got married in 2006, so we have had lots of years to figure out what works and what doesn’t work for us.

(Look at those babies! 😂)

Finally, I am not trying to hold us up as some model couple when it comes to money. We’ve made plenty of mistakes, and we’ve had some wins from time to time. We are continually working to learn and make improvements to our strategy.

But with all those caveats in place, the following has been our money routine for the past several years, and it has worked well for us.

Our Friday “Money Moves”

Most of the money management happens on Fridays at our house.

Throughout the week, Donnie and I both charge all of our transactions to credit cards that we will end up paying off in full each month.

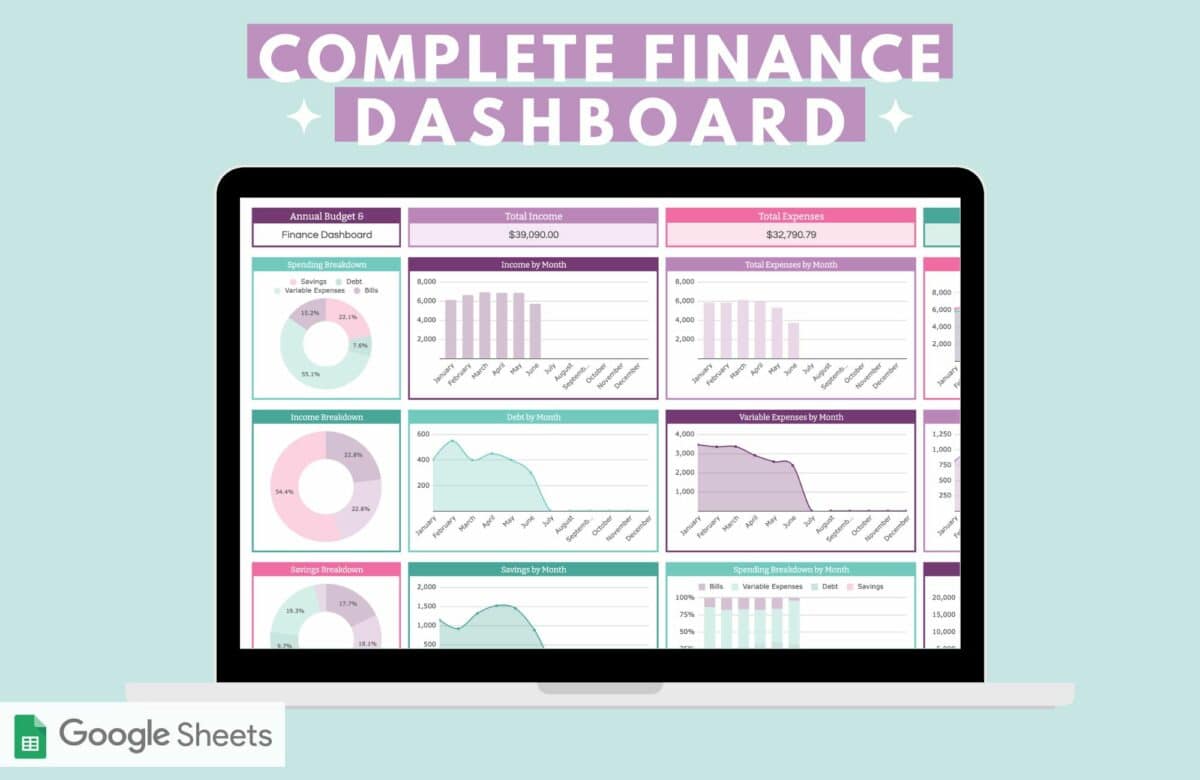

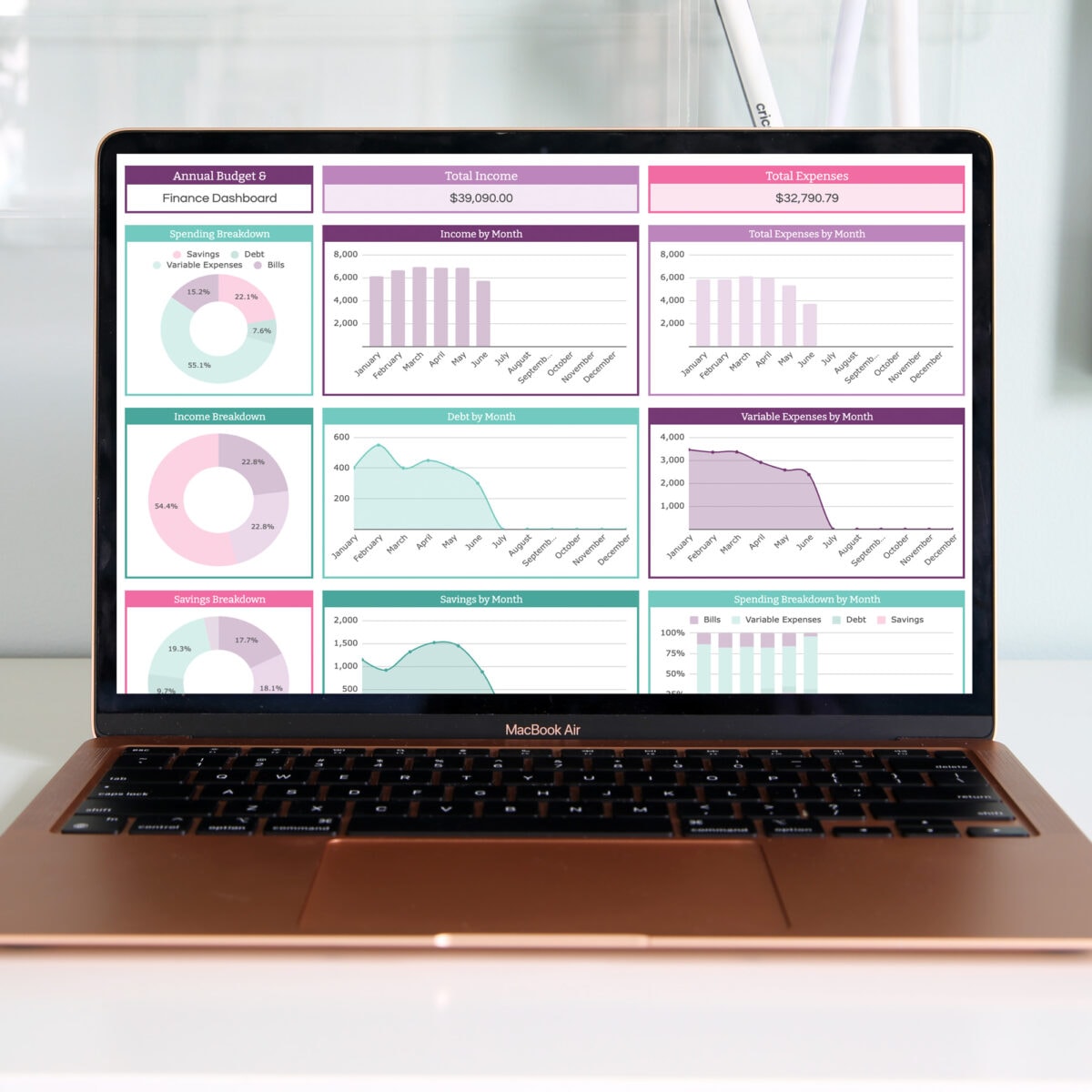

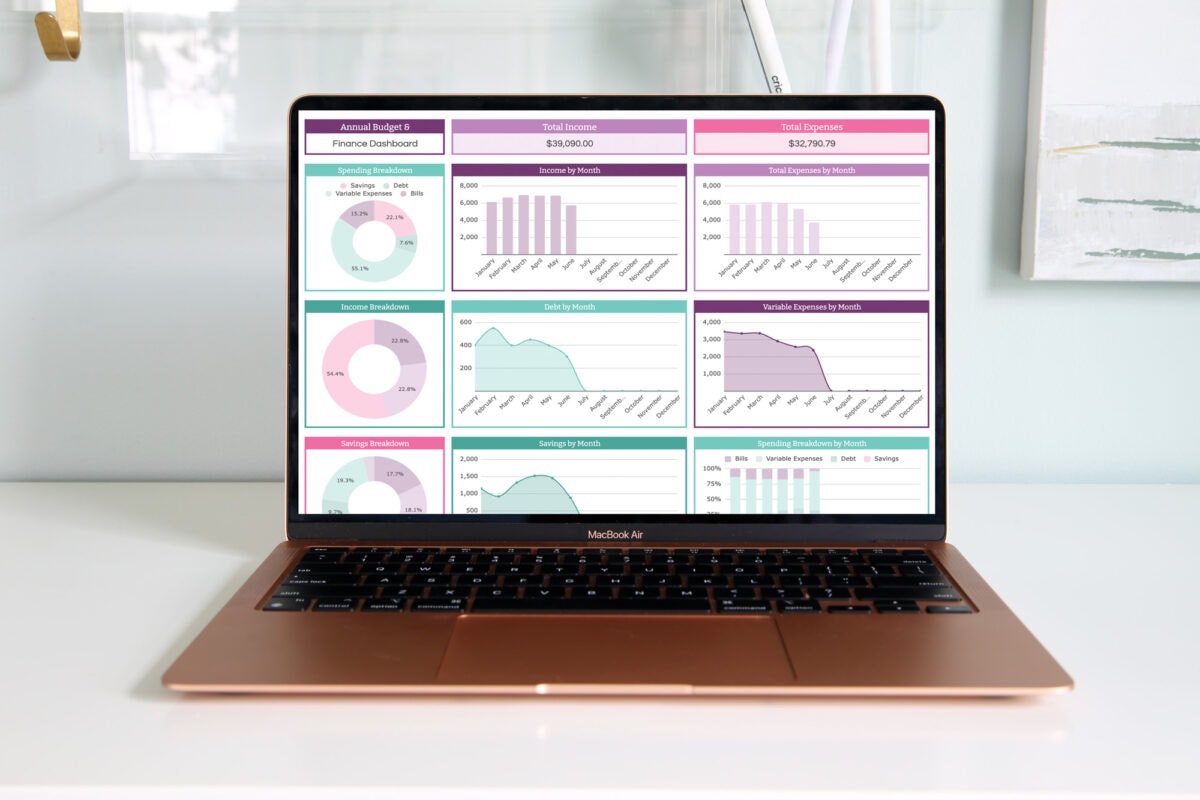

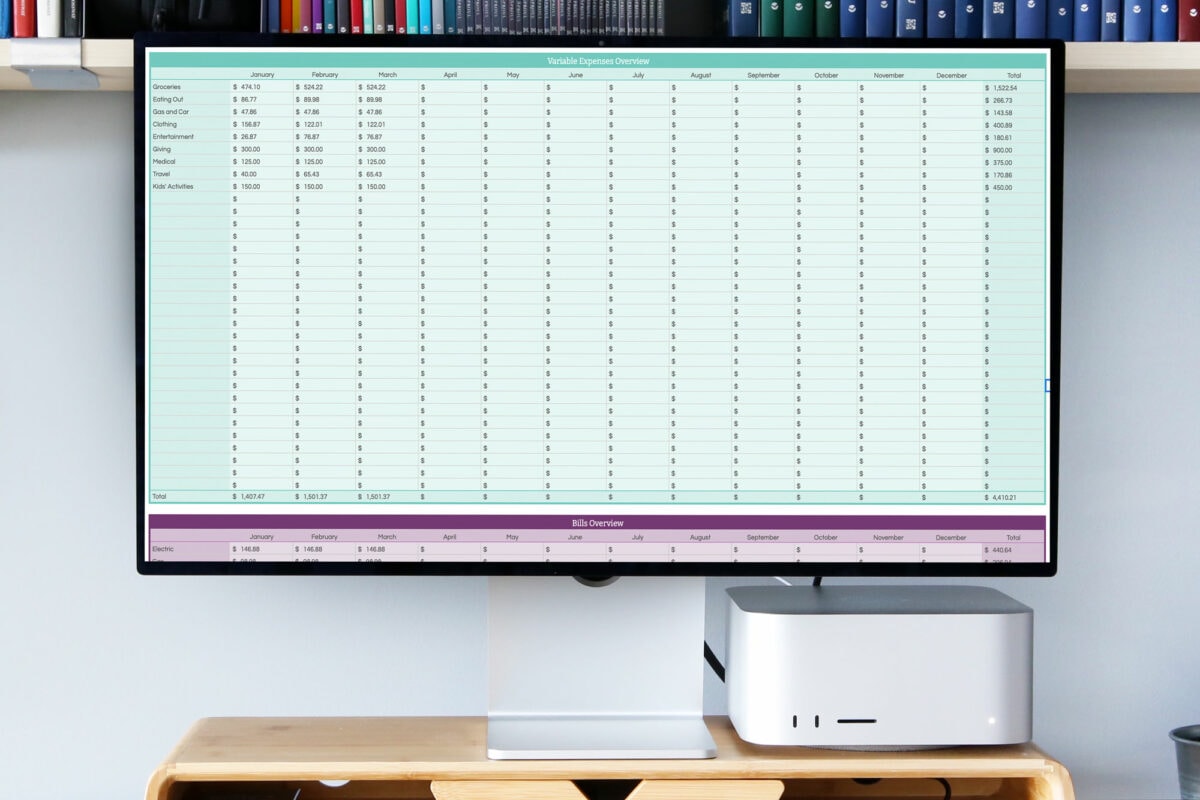

On Fridays, Donnie sends me screenshots of all of his transactions from the week so I can record them in the Complete Finance Dashboard spreadsheet I created to track our finances.

(The categories and budget numbers shown in the images in this post are fictional and do not represent our family’s actual budget or prescriptive budget information.)

Logging Our Transactions in the Complete Finance Dashboard

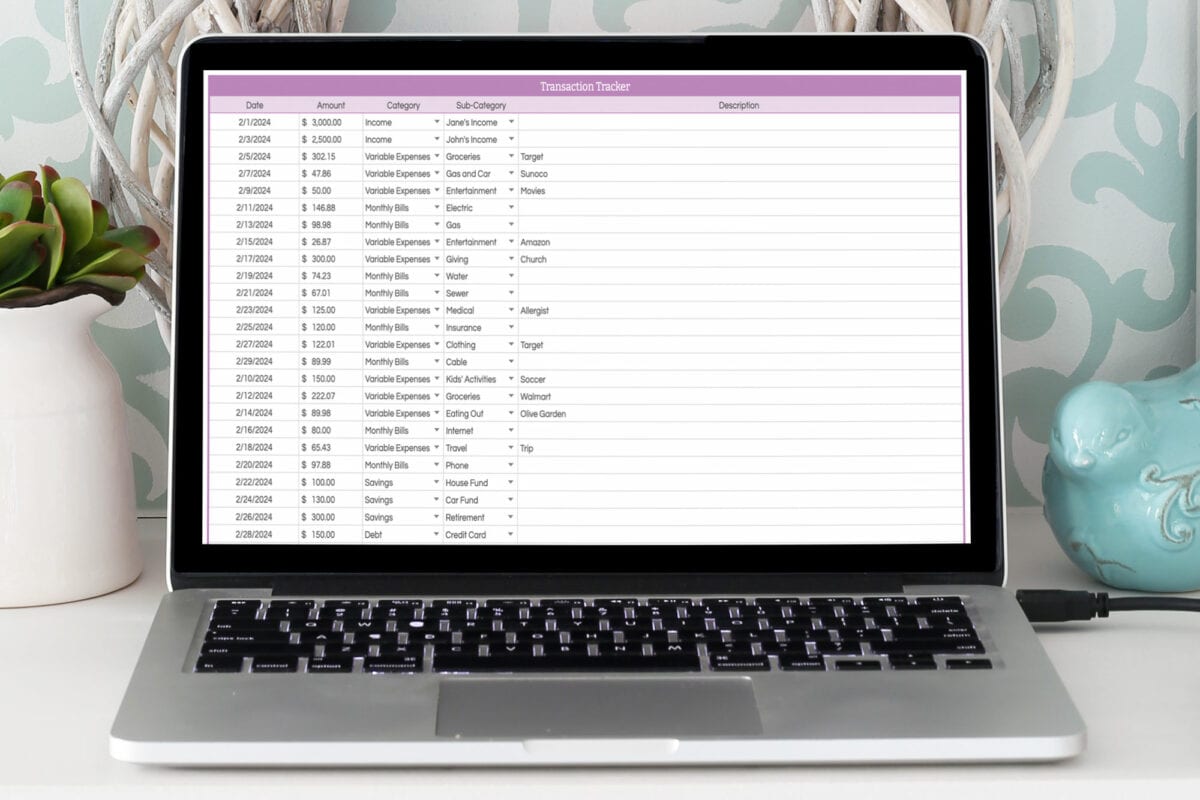

In the transaction log each week, I record…

- Donnie’s transactions from his credit card

- My transactions from my credit card

- Any transactions that have occurred in our bank accounts

When I enter the transactions in the log, I am adding them to categories that I have already set up in our spreadsheet.

For example, when I record a trip to Chipotle, that goes under the “Variable Expenses” category and the “Eating Out” sub-category.

When I record our water bill, that goes under “Monthly Bills” in the “Water” sub-category.

The spreadsheet does the math for me and tallies up the total amount we’ve spent and how much we have left to spend in each category so I always know where we stand.

Managing Our Sinking Funds

Along with tracking our transactions, I also take a look at our sinking funds and savings accounts each Friday to make sure we are on target with our savings goals.

If you’re not familiar, “sinking funds” are where you put aside a certain amount of money each week or month in order to save up for a future expense. Then when the future expense arrives, you already have the money saved, so you don’t need to go into debt to pay for it.

So for example, we currently have sinking funds for Christmas, our family vacation, and a general “emergency” fund that we can dip into for house and car repairs, medical emergencies, etc.

We have automatic transfers set up to put a little bit of money in those accounts each week, which accumulates over time.

Related: What are sinking funds? (And why do I need them?)

Along with looking at our sinking funds, I also check on our retirement accounts and accounts we have set up for our boys’ college funds just to get a general sense of where we stand.

Paying Bills and Transferring Funds

While I’m tracking the budget, Donnie is working on paying the bills.

Every Friday, he pays all the bills that have come in that week. As he’s paying bills, he also makes any necessary transfers between accounts.

- Sometimes he needs to transfer money from savings to checking. (For example, when our hot water tank blew, we paid for it with money from our “emergency” sinking fund, so he moved that amount from savings to checking.)

- Sometimes he transfers money from checking to savings. (Since we are self-employed, our income varies from month to month. If we happen to have a month with a bit of a surplus, he will move extra money to savings.)

- He always moves money from our checking account to our giving account when we get paid so we can tithe to our church and other ministries that are important to us.

Our Weekly Money Conversation

As Donnie and I are in the process of making our “money moves” for the week, we compare notes (sometimes in person, sometimes via text).

We talk about any transfers that need to happen between accounts and make sure we agree about how the money should be distributed.

We talk about the health of our accounts and whether any of them are too low for comfort. If they are, we make a plan to fix that.

If our giving account has built up, we talk about potential ministries or causes we may want to give to.

We talk about our short and long-term money goals and where we stand with those.

I give a budget update and highlight any potential categories we need to keep an eye on that month.

For example, “It’s halfway through the month and we’ve already used 3/4 of our ‘Eating Out’ budget, so we’ll want to minimize eating out for the rest of the month.” (Our Complete Finance Dashboard spreadsheet makes it easy to see exactly what we have left to spend in each category.)

That may sound like a lot to discuss, but it usually only takes about five minutes to compare notes. We don’t end up needing to discuss every single one of those topics every week.

Minimizing Money Stress

A perk of having these short money conversations each week is that Donnie and I never end up needing to have big, stressful “come to Jesus” money discussions after financial stress has built up over time.

We always know where our numbers stand and we work together to mitigate any small issues that arise before they become big problems.

(These conversations don’t happen in the middle of an idyllic field, but I like this picture of us anyway. 😂)

All in all, I’d say we spend about 20-30 minutes per week managing our finances. That small amount of time has paid off tremendously, and we now feel more confident in our financial decisions because we know exactly what is happening with our money.

The Monthly Money Wrap-Up

At the end of each month, I make sure I enter in the last of our transactions on our spreadsheet. Then we take a look at the Annual Budget Dashboard tab of the spreadsheet, which compiles all of our numbers for the year so far.

We can see exactly how much we’ve spent in each category. And we can compare this month to previous months to see how our spending stacked up.

We can also take a look at areas where we think we can cut back or subscriptions we can cancel in order to hone our spending a little more.

Again, this only takes a few minutes to look at since the information is all right there in the spreadsheet for us. But it is incredibly valuable information to have when we’re deciding things like…

- if/where we’ll go on vacation next summer

- whether we’ll be able to afford a new car if ours would break down

- what we’ll be able to contribute, should our boys decide to go to college

- when retirement would be an option and how that will look

- and more!

End-of-Year Financial Wrap-Up

Similar to the wrap-up we do at the end of each month, we will revisit the Annual Budget Dashboard tab in our Complete Finance Dashboard spreadsheet at the end of each year to take a look at our final numbers.

Because everything is broken out by category, analyzing our spending from the previous year will also help us set budget goals for each category for the upcoming year.

Having this data is really valuable because it lets us easily see where we need to raise or lower our budget in various categories. And we’ll be able to more accurately forecast our needs for the new year.

Finally, as we look back at our financial picture from the previous year, we’ll set financial goals for the upcoming year.

- Where do we need to rein in our spending?

- What debts do we want to be more intentional about paying off?

- What are our savings goals for the year?

- Do we foresee any big expenses that we’ll need to take into account?

We can make much more accurate goals and plans when we have a clear view of what our actual numbers have looked like in the past.

Our Family’s Money Routine: Final Thoughts

If you would have told me years ago that I would get excited about working on our budget each week, I would have laughed at you. I thought that finances and budgeting just weren’t my thing.

But once I found the right tools and the right routine that worked well for our family, it made a huge difference for helping us organize our finances. And yes, I actually enjoy crunching our numbers now!

Having a money routine that involves both of us also helps to keep us accountable. If one of us drops the ball, the other one can’t do their part of the routine successfully, so it keeps us motivated to complete the money tasks we’re each responsible for.

That doesn’t mean that everything has always gone perfectly. There have been times when things have gotten tight and times when unexpected expenses derailed our plans.

But both Donnie and I having all of the information and being on the same page has helped us make much smarter decisions and get through whatever money situation may arise together.

Helpful Budgeting Tools

If you’d like to start tracking your spending and honing your household’s money routine, we have several tools that can help!

The tool that our family uses and that I showed in this post is our Complete Finance Dashboard spreadsheet. It has sheets to help manage budgeting, debt payoff, savings/sinking funds, net worth calculations, an annual dashboard, and more.

If you’re just getting started with budgeting and want to simply budget from month to month, our Monthly Budget Spreadsheet can help with that.

And if you’d like to get started with budgeting and prefer a free option, you can always grab our printable Budget Binder pages.

Whatever tool you end up using, know that I am rooting for you! I can’t wait to see all the progress you make toward your financial goals in the coming months and years.

Happy Budgeting!

Want to save this post to revisit later? Be sure to pin the image below so you can find it easily!

More Money Saving Ideas

Thank you so much for following along! Have a wonderful day!

I am not a financial professional. The information in this post is for educational purposes only and is not considered personalized financial advice.